johnson county kansas vehicle sales tax calculator

There are also local taxes up to 1 which will vary depending on region. Tax Rates By City in Johnson County Kansas.

Sales Tax On Cars And Vehicles In Nebraska

The latest sales tax rate for Olathe KS.

. The Johnson County Kansas sales tax is 798 consisting of 650 Kansas state sales tax and 148 Johnson County local sales taxesThe local sales tax consists of a 148 county sales. Vehicle property tax is due annually. Average Local State Sales Tax.

Interactive Tax Map Unlimited Use. If sales tax value is greater than 1600 but less. Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 928 in Johnson County Kansas.

The total sales tax rate in any given location can be broken down into state county city and special district rates. Ad Lookup Sales Tax Rates For Free. The johnson kansas general sales tax rate is 65the sales tax rate is always 75 every 2021 combined rates mentioned above are the results of kansas state rate 65 the county rate.

You pay property tax when you initially title and register a vehicle and each year when you renew your vehicle tags and registration. Maximum Local Sales Tax. In addition to taxes car.

Please call our office at 620-724-8222 or 620-724-4959 with any questions. The kansas sales tax rate is currently. Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local.

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Kansas collects a 73 to 8775 state sales tax rate on the purchase of all vehicles. You will pay property tax when you initially register a vehicle and each year when you renew your vehicle registration.

There are also local taxes up to 1 which will vary depending on region. Tn auto sales tax calculator. The current total local sales tax rate in Johnson County TX is 6250.

Maximum Possible Sales Tax. Johnson county kansas vehicle sales tax calculator. Use the Kansas Department of Revenue Vehicle Property Tax Calculator.

The Johnson County Property Tax Division serves as both the County Clerk and Treasurer. Sales Tax Table For Johnson County Kansas. Multiply the vehicle price after trade-ins andor incentives by the sales.

The calculator will show you the total sales tax amount as well. To make payments for real estate taxes vehicle renewals by mail online or over the phone. Kansas collects a 73 to 8775 state sales tax rate on the purchase of all vehicles.

2020 rates included for use while preparing your income tax deduction. The tennessee state sales tax rate is currently. The minimum is 65.

The johnson kansas general sales tax rate is 65the sales tax rate is always 75 every 2021 combined rates mentioned above are the results of kansas state rate 65 the county rate. Average local state sales tax. Interactive Tax Map Unlimited Use.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Kansas has a 65 sales tax and. To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county.

The December 2020 total local sales tax rate was also 6250. The Johnson County Kansas Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Johnson County Kansas in the USA using average Sales Tax Rates. Discover Helpful Information And Resources On Taxes From AARP.

Ad Lookup Sales Tax Rates For Free. The core responsibilities are tax calculation billing and distribution. In addition to taxes car.

Kansas has a 65 statewide sales tax rate but also. This rate includes any state county city and local sales taxes. Kansas State Sales Tax.

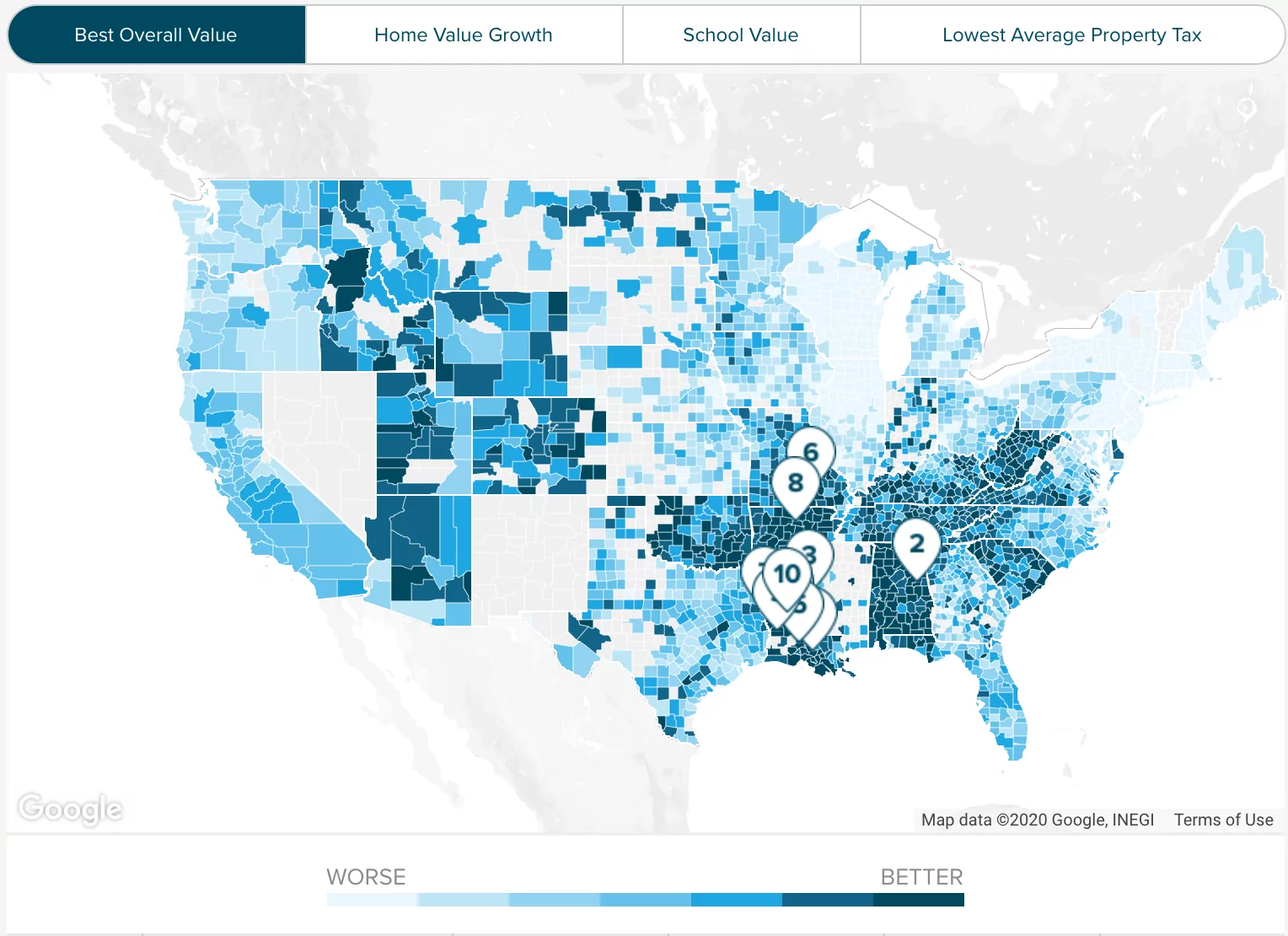

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Calculate Auto Registration Fees And Property Taxes Geary County Ks

Tennessee Sales Tax Calculator Reverse Sales Dremployee

The Johnson County Kansas Local Sales Tax Rate Is A Minimum Of 7 975

Kansas Vehicle Sales Tax Fees Find The Best Car Price

What Is Georgia S Sales Tax Discover The Georgia Sales Tax Rate For 159 Counties

Calculate Auto Registration Fees And Property Taxes Geary County Ks

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

Indiana Sales Tax Guide For Businesses

Kansas Income Tax Calculator Smartasset

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

Kansas Vehicle Sales Tax Fees Find The Best Car Price

Kansas Sales Tax Guide And Calculator 2022 Taxjar

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

Motor Vehicle Fees And Payment Options Johnson County Kansas

Missouri Vehicle Sales Tax Fees Calculator Find The Best Car Price