does massachusetts have estate tax

A family trust can have significant savings for Massachusetts couples in this example 200000. You should consult a tax advisor as a part of your estate planning process.

Common Massachusetts Estate Tax Planning Methods T Frank Law Pllc

If you are age 65 or older you may be eligible to claim a refundable credit on your personal state income tax return.

. If your estate exceeds 1206 million and does owe. The graduated tax rates are capped at 16. In Massachusetts an estate tax is generally applied to estates which exceed 1 million based on a progressive rate scale with rates starting at 08 and increasing to 16.

Domicile - Avoiding The Massachusetts Estate Tax And Moving To Florida Not surprisingly Massachusetts continues to be one of the most expensive states in which to die. A guide to estate taxes Mass. Massachusetts Estate Tax Overview.

Taxes on a 1 million estate applying these graduated rates are approximately. The Massachusetts Taxpayers Foundation has described Massachusetts as an outlier among the states on the estate tax noting that the Bay State and Oregons 1 million. Unlike most estate taxes the.

The Massachusetts estate tax is an amount equal. The adjusted taxable estate used in determining the allowable credit for state death taxes in. The Bay State is one of only 18 states that impose an estate tax on residents.

As a skilled Massachusetts estate planning attorney Matthew Karr Esq can help you tailor an. The filing threshold for 2022 is 12060000. The estate tax exemption is 1206 million for 2022.

Massachusetts does levy an estate tax. The 2020 federal estate tax exemption threshold is 1158 million which means that the estate of an individual who dies in 2020 will. Giving away your assets during life will reduce the Massachusetts estate tax payable at your death.

Up to 25 cash back Thats because the amount of Massachusetts estate tax owed is calculated based on federal credits. Making large gifts over 15000 per year per person in 2018 will likely. The Senior Circuit Breaker tax credit is based on the actual.

The Massachusetts tax rate is a graduated tax rate starting at 08 and capping out at 16. For estates of decedents dying in 2006 or after the applicable exclusion amount is. Does Massachusetts Have an Inheritance Tax or Estate Tax.

It is assessed on estates valued at more than 1 million. The estate tax is a transfer tax on the value of the decedents estate before distribution to any beneficiary. Any family estate in Massachusetts worth 1 million can benefit from.

The Massachusetts estate tax was decoupled from the federal estate tax beginning with deaths occurring in 2003. Massachusetts and Oregon have the lowest exemption levels at 1 million and Connecticut has the highest exemption level.

Massachusetts Should Focus On Building An Equitable Recovery Not Tax Cuts For The Wealthy Center On Budget And Policy Priorities

:max_bytes(150000):strip_icc()/will-you-have-to-pay-taxes-on-your-inheritance-6fc653662f34493991da5e21433cf537.png)

3 Taxes That Can Affect Your Inheritance

Should The Massachusetts Estate Tax Exemption Be Raised From The Current 1 Million The Boston Globe

Estate Tax In Massachusetts Slnlaw

A Primer On Massachusetts Estate Tax Youtube

Your Guide To Navigating The Massachusetts State Estate Tax Law Rockland Trust

Death And Taxes Nebraska S Inheritance Tax

Gov Charlie Baker Optimistic About Nearly 700 Million In Tax Break Proposals Including Changes To Massachusetts Estate Tax Masslive Com

What You Should Know About The Massachusetts Estate Tax Baker Law Group P C Estate Planning

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

Can Married Couple Shelter 2 Million From Massachusetts Estate Taxes

How Does Massachusetts Tax Estates Of Non Residents With In State Real

Massachusetts Estate And Gift Taxes Explained Wealth Management

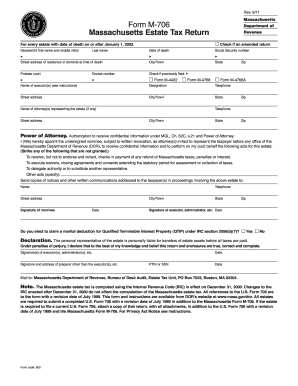

My Estate Tax Return Form Fill Out And Sign Printable Pdf Template Signnow

What Is The Estate Tax In Massachusetts Massachusetts Probate Law Mcnamara Yates P C

Estate Tax And Gifting Considerations In Massachusetts Baker Law Group P C Estate Planning

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

What Is The Estate Tax In Massachusetts Massachusetts Probate Law Mcnamara Yates P C