haven't done my taxes

Whether you owe taxes or youre expecting a refund you can find out your tax returns status by. Ad You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes.

Haven T Done My Taxes I M Too Turnt Up R Memes

Whether you are filing as an individual or as a business you likely will see a few changes this year when you file your 2018 federal income tax return.

. People may get behind on their taxes unintentionally. In 2020 I started a new self employment in august. Subscribe to RSS Feed.

You may also face late filing penalties. Level 15 July 14 2022 214 PM. Ad Get Expert Advice on Tax Litigation Resolution More.

The criminal penalties include up to one year in prison for each year you failed to file and. If you owe taxes and did not file your income tax return on time the CRA will charge you a late filing penalty of 5 of the income tax owing for that year. Get Help with Multiple Years of Unfiled Taxes.

Get A Resolution for Your Tax Case with The Law Office of David Lee Rice. Hello everyone I havent doney taxes in the past 7-8 years and its time for me to do them. Services include Auto-fill my return Express notice of assessment Online mail Submit documents and track your refund.

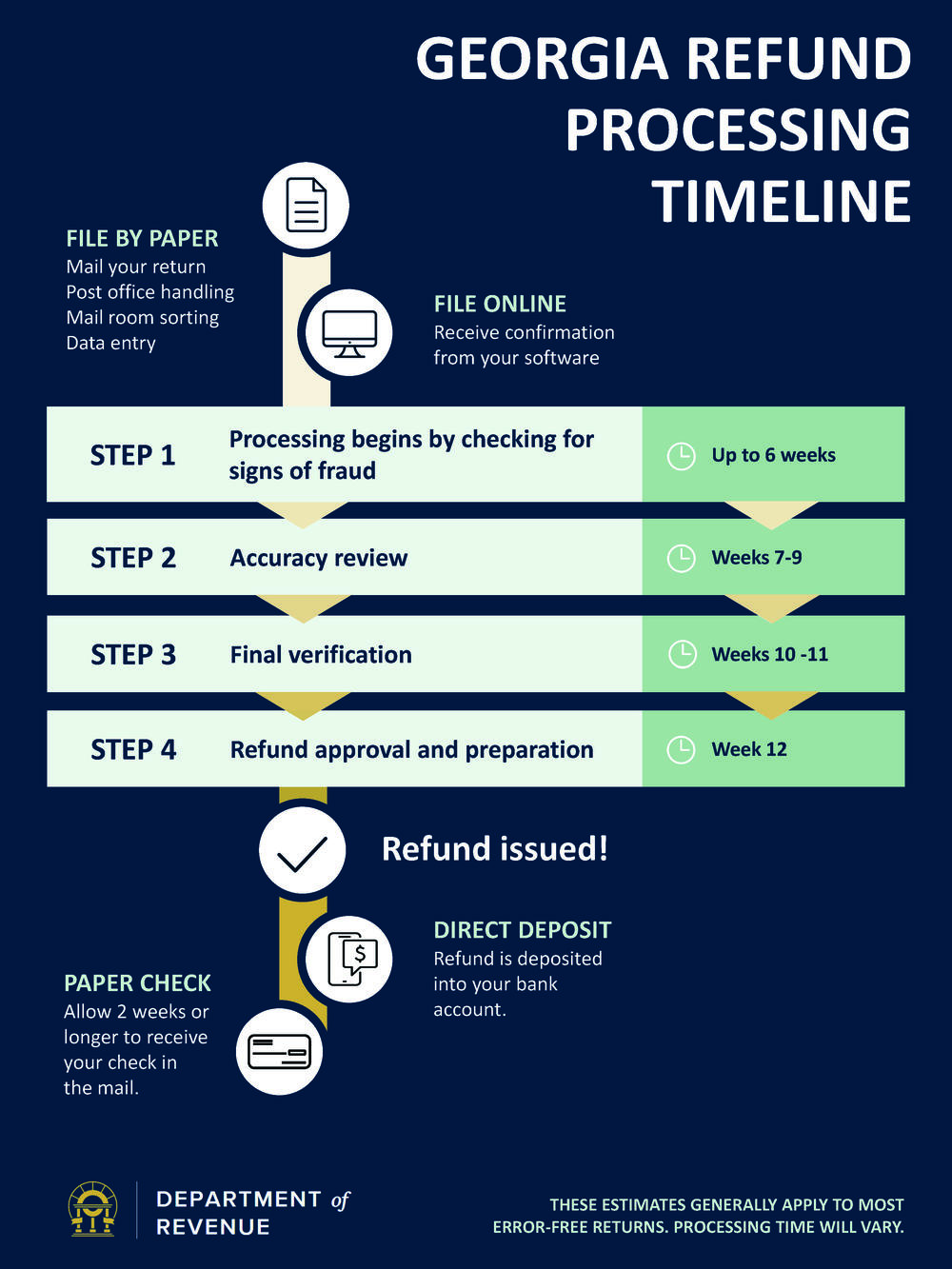

Perhaps there was a death in the family or you suffered a serious illness. Sometimes the IRS will literally send delinquent taxpayers a bill in a process known asSubstitute for Returns SFRs. The Baker administration also set up a website wwwmassgov62frefunds where you can get a preliminary estimate of your refund.

Any unpaid taxes child support or other types of debt may impact the. My last taxes was in 2019 I paid no taxes. This penalty is 5 per month for each month you havent filed up to a maximum of 25 over 5 months.

Compare 2022s 5 Best Tax Relief Companies. Lilbaby lifeisgood drake future Baby goes Live on IG vibe to Drake Future new song Life is Good and says I havent done my taxes Im too turnt up. I dont have all of my 1099 from my employer so I went on the IRS.

Ad Theres No Need To Be Scared of The IRS - The Best Tax Relief Companies On Your Side. A Rated W BBB. If you fail to file your taxes youll be assessed a failure to file penalty.

4 hours agoCHICAGO WLS -- If you havent paid your property tax bill you need to do it immediately so your property taxes wont be offered up for auction. Rated 1 Overall by Investopedia. In order to be qualified for the rebate state tax returns must have been filed by October 17 2022.

I havent done my 2020 taxes yet and honestly havent even been a year since I. Call Now for a Consult. If youre required to file a tax return and you dont file you will have committed a crime.

Take advantage of all the available tools found on. But if you filed your tax return 60 days after the due date or the. If you filed an extension and paid at least 90 of your taxes owed you may not owe the failure-to-pay penalty.

The penalty charge will not exceed 25 of your total taxes owed. Find the Best Company for You. Using the IRS Wheres My Refund tool Viewing your IRS account information.

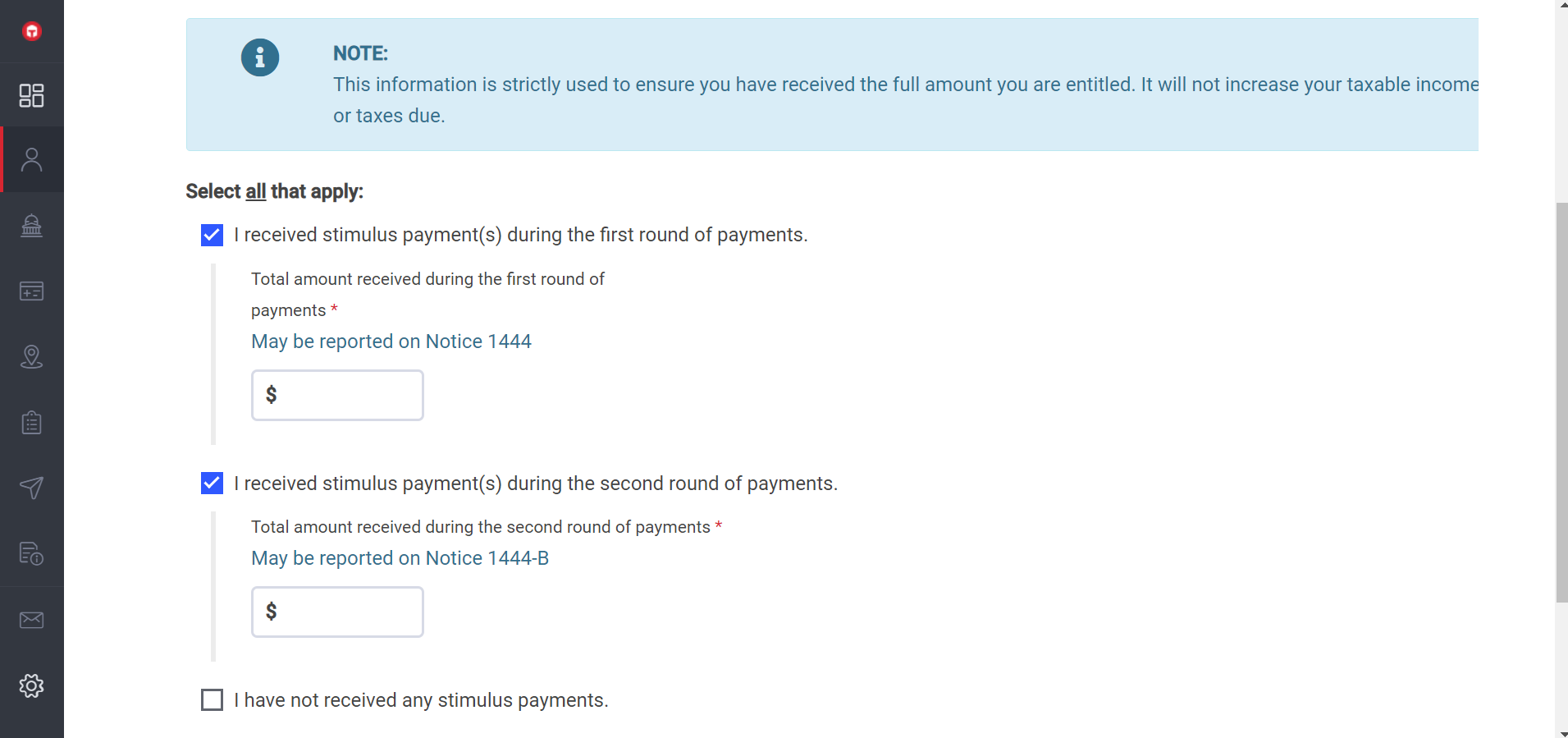

Plus if you havent filed your tax return yet you could be missing out on a 1400 stimulus check if you dont do so by November 17. Rated 1 Overall by Investopedia. Heres what to do if you havent filed taxes in years.

Ad Over 1500 5 Star Reviews. Individuals who want to file returns on paper can. A call center is also now available at 877.

Contact the CRA If the CRA hasnt been trying to contact you for the years that you havent filed taxes consider that a good. The Cook County tax sale. Whatever the reason once you havent filed for.

Get Immediate Help with a Free Confidential Consultation. Premium federal filing is 100 free with no upgrades for premium taxes. Get Help with Multiple Years of Unfiled Taxes.

Ad Over 1500 5 Star Reviews. Avoid penalties and interest by getting your taxes forgiven today. Get Immediate Help with a Free Confidential Consultation.

A Rated W BBB. But you will have to pay the remaining tax balance by the. 1099s not showing on IRS website.

If you are one of the many. Here are the states with stimulus checks. This happens when the agency has enough.

This penalty is usually 5 of the unpaid taxes. Check out my new podcast Garage Boys. I havent done my taxes 0 3 125 Reply.

Regardless of your reason for not filing you should file your federal tax return as soon as possible. The late payment penalty not to be confused with the late filing penalty amounts to 050 of. Ad Federal Tax Filing is Always Free for Everyone.

Youll also face a separate penalty for not paying your actual tax bill by April 18.

How States Are Making Care Less Taxing In Tax Year 2019 National Women S Law Center

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

New Mexico Families Eligible For Household Relief Taxation And Revenue New Mexico

Wash Sale Rule What To Avoid When Selling Your Investments For A Tax Loss Bankrate

When Will You Get Your Inflation Relief Check California Announces New Dates For Debit Cards

Millions Of Americans Might Not Get Stimulus Checks Some Might Be Tricked Into Paying Turbotax To Get Theirs Propublica

How To Claim An Undelivered Tax Refund Congressman Brad Sherman

Found On Ifunny Funny Dancing Gif Bobby Shmurda Edgy Memes

Don T Forget Tax Deadline This Wednesday Congressman Mike Quigley

Top 5 Things To Know If You Haven T Filed Your Tax Return Yet

What Do I Do If I Didn T Get My Stimulus Checks Get It Back

What Happens If I Don T File My Taxes Forbes Advisor

Haven T Filed Taxes In Years What You Should Do Youtube

Penalties For Filing Your Tax Return Late Kiplinger

Haven T Filed Taxes In 1 2 3 5 Or 10 Years Impact By Year

California Gas Rebate Your Questions Answered Calmatters

As Home Sale Prices Surge A Tax Bill May Follow The New York Times

Direct Deposit Or Debit Card Here S How Californians Will Receive Inflation Relief Checks